In our previous article, The Value of Data and Decision Intelligence in 2021 — and Onward, we took a deep dive into why data management is so integral to the mortgage industry in 2021 and beyond, how lenders can use their data to assess the efficiency of their business operations, and why data and decision intelligence are integral to innovative leaders in the industry. Here, we are taking a closer look at decision intelligence and why mortgage executives are prioritizing this new concept in their business operations.

1. Confidence in Decision-Making

As we saw in 2020, mortgage executives, like executives in just about every other industry, were forced to make critical business decisions that involved thousands of people and millions of dollars. These choices were piercing and subject to intense scrutiny—from employees, government officials, and the general public—as the nation experienced volatility like no other; in those moments, the executives’ confidence in their judgements were more important than ever.

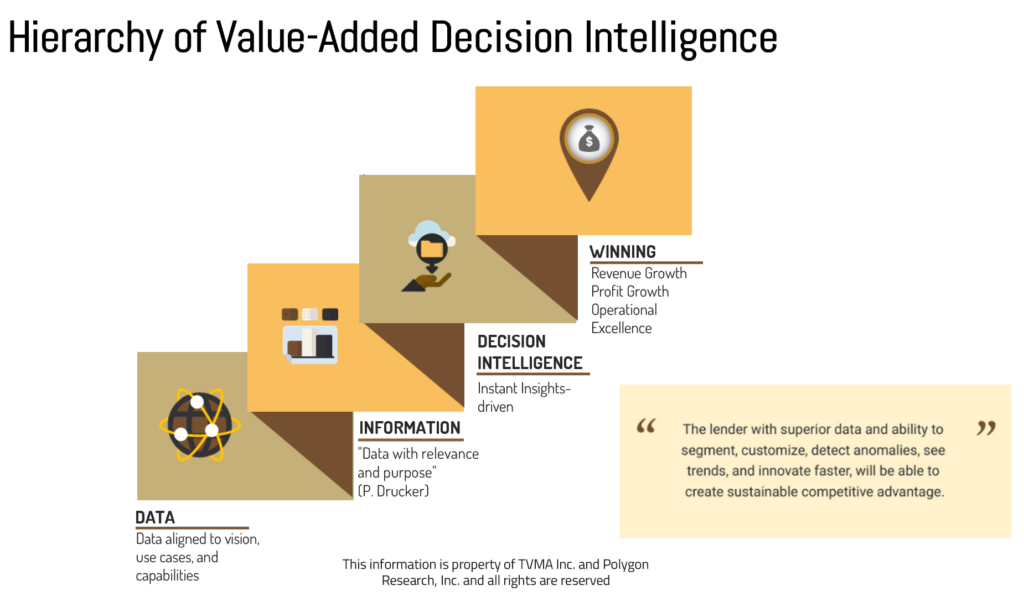

An executive’s confidence in their business decisions stems directly from their decision intelligence. In the make-or-break climate that organizations face today, the ability to make good judgement calls backed by reliable and properly assessed data cannot be emphasized enough. One bad call can set a company up for failure or displace thousands of employees.

Having impeccable logic and reasoning skills is equally as important as vetting harnessed data for quality assurance and proper interpretation. Data intelligence and quality data management lay the foundation of sophisticated decision intelligence.

Ensuring that business strategies are backed by valuable metrics poises an executive to make decisions that truly resolve a deficiency or harness an opportunity instead of taking shots in the dark–especially when everything is on the line.

2. Reduce Labor Cost

Above all, reduced labor costs are why executives are turning to decision intelligence when overseeing their organizations.

Decision intelligence cultivates business strategies that reduce overall cost of operation: outsourcing processes that are not essential in-house operations, automating processes where significant manpower is unnecessary, or internally resolving revenue leakage and unproductivity issues that previously were discoverable only by external consultants, among other solutions.

Executives who utilize data management systems that reveal information about their own company’s strengths and weaknesses in turn become more streamlined and cost-effective as they rely on themselves and their team to make judgement calls instead of throwing unnecessary dollars and manpower at the problem, only to come to the same conclusion.

3.Efficiently Address Areas of Improvement

Many executives are far removed from the day-to-day operations of their organizations—literally and figuratively. Without abundant data about their company, its processes, and its productivity, an executive must rely on general reports, word-of-mouth, and public perception to understand where the opportunities and areas of improvement lie—all of which are somewhat helpful, but still unideal for serious decision-making.

Executives place so much value on decision intelligence because it relies on raw data and metrics to address potential areas of improvement. A vague idea of where inefficiencies reside in a company’s processes becomes significantly more tangible and consequently more manageable when numbers and data visualization are applied to deepen the understanding of the inner workings of the organization.

The more information that an executive harnesses about their business, and the more deeply they understand their operations, the more effectively they can analyze what must be improved on and do so in a more efficient manner. In turn, the more efficient an organization is, the more competitively it operates in its industry.

Building The Path Forward

Data analytics help you pivot your focus to quality over quantity. Sophisticated data management, now more than ever, is a non-negotiable means to maintain an edge over competitors. Leaders seeking to become more data-driven and consumer-centric are turning to partners like Teraverde.

2021 is the year that you turn to a trusted partner with seasoned mortgage and loan origination technology expertise. Consider the importance of data and maximize your lending capacity and decision intelligence with Teraverde. Check out the Data Strategy Webinar for more Information on Data Strategy for Mortgage Executives.