This crisis is following a similar trajectory of other crises, except this is two crises together — a public health crisis and an economic crisis. The genesis of every crisis is a lack of confidence. When loved ones’ health and economic durability are both threatened, the reaction is big. When there are many ‘unknown unknows’ (a favorite phrase of former Secretary of Defense Donald Rumsfeld), it creates even more volatility.

This crisis is following a similar trajectory of other crises, except this is two crises together — a public health crisis and an economic crisis. The genesis of every crisis is a lack of confidence. When loved ones’ health and economic durability are both threatened, the reaction is big. When there are many ‘unknown unknows’ (a favorite phrase of former Secretary of Defense Donald Rumsfeld), it creates even more volatility.

I spoke with Rumsfeld in 2006, at the beginning of the mortgage crisis, and on the cusp of the U.S. Military’s ‘surge’ in Iraq. Paraphrased, Rumsfeld said, “The lack of clarity and high uncertainty (‘unknown unknowns’) amplifies volatility in behavior, whether it is humans or markets. Volatility can be vicious and inflect a lot of pain.” Volatility from lack of confidence is what we have now.

I researched the sequence of events of the height of the mortgage market crisis of 2007 and how and why it ended. I am sharing the events below from a chapter in my book. I hope you take two things away if you choose to read the chapter (it’s short).

-

America has an incredible long-term resilience, so I have the confidence we’ll get through this and prosperity will return,

-

Confidence is more important than anything else. The huge sell-off in equity, fixed income and precious metals was a sign that confidence is low, ‘unknown unknows’ created great anxiety and a rush to cash trampled any semblance of an orderly market. This will pass when the western governments collectively flood the market with liquidity and a sense of a path forward.

If you believe the first item, show it in your daily behaviors. Confidence is contagious.

If you believe the second, consider calling your federal elected representative and encourage thoughtful action with a minimum of partisanship. This is a bipartisan issue, and stateman-like behavior inspires confidence.

Here’s the chapter:

Appendix 2: The Financial Crisis of 2007-2010 and Beyond.

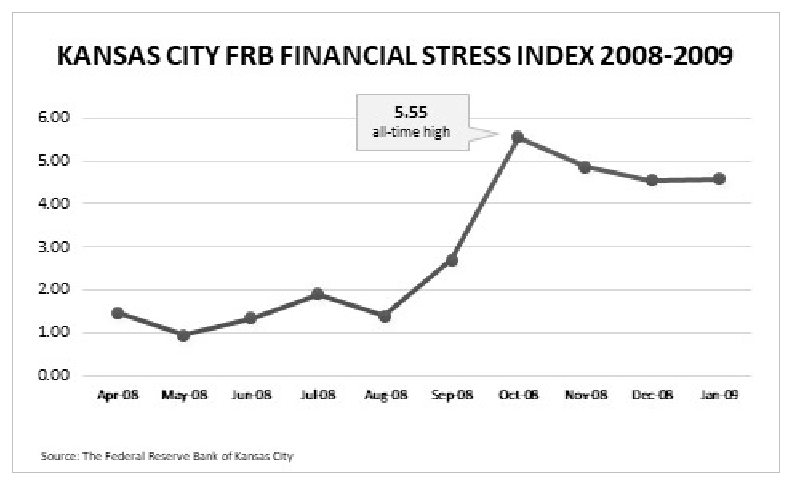

The extreme stress in the financial markets in the late summer and early fall of 2008 was quantified by the Kansas City Financial Stress Index (KCFSI), a monthly measure of stress in the U.S. financial system based on 11 financial market variables issued by the Kansas City Federal Reserve Bank. A positive value indicates that financial stress is above the long-run average, while a negative value signifies that financial stress is below the long-run average. The KCFSI decreased from 1.47 in April 2008 to 0.94 in May 31, 2008 . . . followed by an almost six-fold increase to an all-time high as of 5.55 as of October 2008. This unexpected and unprecedented increase in financial stress as quantified by the KCFSI was the proximate cause of rapid declines in asset prices.

The failure of several subprime mortgage lenders in 2007 reduced the availability of credit to subprime borrowers. New Century Financial Corporation, a real estate investment trust founded in 1995 and headquartered in Irvine, California declared bankruptcy on April 2, 2007. On July 11, 2007, credit rating agencies S&P and Moody’s announced the downgrade of $12 billion and $5 billion of subprime RMBS, respectively. Bear Stearns placed two structured and asset-backed securities hedge funds in bankruptcy on July 31, 2007. American Home Mortgage Investment Corp, a large subprime lender, filed for bankruptcy on August 6, 2007. In 2007, losses on subprime mortgage-related financial assets began to cause strains in global financial markets. In December 2007, the U.S. economy entered a recession.

Despite the failures cited above, the markets in early 2008 did not act as if the economy was in severe trouble. On January 11, 2008, for example, Bank of America announced an agreement to purchase Countrywide Financial Corp for $4 billion in stock. Bear Stearns was acquired by JPMorgan Chase on March 16, 2008. The Federal Reserve agreed to guarantee $30 billion of Bear Stearns’ assets in connection with the government-sponsored sale of the investment bank to JPMorgan Chase.

As of late May 2008, the financial markets continued to show signs of stress, but the stress was largely confined to the subprime market, and significant actions by the Federal Reserve and other central banks appeared to be addressing subprime mortgage matters. For example, the Federal Reserve responded to an apparent lack of liquidity in worldwide financial markets with sharp reductions in the federal funds rate, reducing the rate from 5.25% in May 2007 to 2.00% as of April 30, 2008. The Federal Reserve press release stated, “The substantial easing of monetary policy to date, combined with ongoing measures to foster market liquidity, should help to promote moderate growth over time and to mitigate risks to economic activity.” On May 8, 2008, the Federal Reserve provided an increase in the amounts auctioned to eligible depository institutions under its biweekly Term Auction Facility (“TAF”) to bring the amounts outstanding under the TAF to $150 billion, again to increase liquidity.

For example, prior to the failure of Fannie Mae, the company issued the following unexpected and extraordinary description of events occurring after the close of its second quarter 2008 (the note below was included in Fannie Mae’s June 30, 2008, Form 10-Q, released August 9, 2008):

Market Events of July 2008:

In mid-July, following the close of the second quarter, liquidity and trading levels in the capital markets became extremely volatile, and the functioning of the markets was disrupted. The market value of our common stock dropped rapidly, to its lowest level since October 1990, and we experienced reduced demand for our unsecured debt and MBS products. This market disruption caused a significant increase in our cost of funding and a substantial increase in market-to-market losses on our trading securities arising from a significant widening of credit spreads. In addition, during July, credit performance continued to deteriorate, and we recorded charge-offs and foreclosed property expenses that were higher than we had experienced in any month during the second quarter and higher than we expected, driven by higher defaults and higher loan loss severities in markets most affected by the steep home price declines. Greater credit losses in July not only reduce our July net income through our actual realized losses, but also affect us as we expect that we will need to make further increases to our combined loss reserves in the second half of 2008 to incorporate our experience in July.

Less than 30 days after this 10-Q release, in early September 2008, Fannie Mae was in unexpected conservatorship. In addition, four other major publicly traded companies were unexpectedly placed in conservatorship, bankruptcy or acquired under duress. The companies and their impact on the financial services marketplace listed below in September 2008 were extraordinary:

• Freddie Mac and Fannie Mae owned or guaranteed $4 trillion in mortgage loans at the time of their failure, or 40% of all residential mortgage loans outstanding in the U.S.

• AIG had assets of over $1 trillion at the time of its takeover.

• Washington Mutual and Wachovia assets totaled over $1 trillion at the time of their takeover.

The failure of these five financial firms, with a collective total of $6 trillion of assets heavily involved in the U.S. housing market, in one month (September 6 to October 7, 2008), had an overwhelming adverse impact on liquidity and price discovery in financial markets.

The unexpected nature of the stress in the financial markets is illustrated in the sharp climb in bank failures. Total assets of failed banks from the beginning of 2007 through June 1, 2008 were just under $5 billion. By October 1, 2008 the total assets of failed banks had grown to $350 billion, an increase of 70 times. A total of 7 banks failed from January 1, 2005 to June 4, 2008. Another 27 failed from June 1, 2008 to January 31, 2009. Ultimately, 468 banks with total assets of $690 billion failed from January 1, 2005 through December 31, 2012.

On July 11, 2008, IndyMac Bank, F.S.B., Pasadena, CA, was closed by the Office of Thrift Supervision. The Federal Deposit Insurance Corporation was named conservator. IndyMac Bank, FSB had total assets of $32.01 billion and total deposits of $19.06 billion as of March 31, 2008. The prior FDIC-insured failure in California was the Southern Pacific Bank, Torrance, on February 7, 2003.

On July 13, 2008, the Board of Governors of the Federal Reserve System announced that it had granted the Federal Reserve Bank of New York the authority to lend to Fannie Mae and Freddie Mac should such lending prove necessary and that any lending would be at the primary credit rate and collateralized by U.S. government and federal agency securities. This authorization was intended to supplement the Treasury’s existing lending authority and to help ensure the ability of Fannie Mae and Freddie Mac to promote the availability of home mortgage credit during a period of stress in financial markets. At the same time, the U.S. Treasury Department announced a temporary increase in the credit lines of Fannie Mae and Freddie Mac and a temporary authorization for the Treasury to purchase equity in either GSE if needed.

On July 15, 2008, the Securities and Exchange Commission issued an emergency order to enhance investor protections against “naked” short selling in the securities of Fannie Mae, Freddie Mac, and primary dealers at commercial and investment banks.

On July 30, 2008, President Bush signed the Housing and Economic Recovery Act of 2008 (Public Law 110-289), which, among other provisions, authorized the Treasury to purchase GSE obligations and reforms the regulatory supervision of the GSEs under a new Federal Housing Finance Agency.

On July 30, 2008, the Federal Reserve announced several steps to enhance the effectiveness of its existing liquidity facilities, including the introduction of longer terms to maturity in its Term Auction Facility Extension of the Primary Dealer Credit Facility (PDCF) and the Term Securities Lending Facility (TSLF,

The Federal Housing Finance Agency (FHFA) initiated the conservatorships of the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) on September 6, 2008. The U.S. Treasury Department announced three additional measures to complement the FHFA’s decision: 1) Preferred stock purchase agreements between the Treasury/FHFA and Fannie Mae and Freddie Mac to ensure the GSEs positive net worth; 2) a new secured lending facility available to Fannie Mae, Freddie Mac, and the Federal Home Loan Banks; and 3) a temporary program to purchase GSE MBS.

On September 14, 2008, the Federal Reserve Board announced a significant broadening in the collateral accepted under its existing liquidity program for primary dealers and financial markets to provide additional support to financial markets.

On September 15, 2008, Bank of America announced its intent to purchase Merrill Lynch & Co. for $50 billion.

Also, on September 15, 2008 Lehman Brothers filed for federal bankruptcy protection.

Credit rating agencies downgraded AIG’s long-term credit rating on the afternoon of September 15, 2008. AIG’s stock price plunged. AIG could not access short-term liquid funds in the credit markets.

On September 16, 2008, the Federal Reserve Board, with the full support of the Treasury Department, authorized the Federal Reserve Bank of New York to lend up to $85 billion to AIG under section 13(3) of the Federal Reserve Act.

The net asset value of shares in the Reserve Primary Money Fund fell below $1, primarily due to losses on Lehman Brothers commercial paper and medium-term notes, further disrupting liquidity in the money markets.

On September 17, 2008, the Securities and Exchange Commission took several coordinated actions to strengthen investor protections against “naked” short selling. The Commission’s actions applied to the securities of all public companies, including all companies in the financial sector. The actions were effective at 12:01 a.m. ET on Thursday, September 18, 2008.

On September 18, 2008, the Bank of Canada, the Bank of England, the European Central Bank (ECB), the Federal Reserve, the Bank of Japan, and the Swiss National Bank announced coordinated measures designed to address the continued elevated pressures in U.S. dollar short-term funding markets and to improve the liquidity conditions in global financial markets.

On September 19, 2008, the Federal Reserve Board announced two enhancements to its programs to provide liquidity to markets. One initiative extended non-recourse loans at the primary credit rate to U.S. depository institutions and bank holding companies to finance their purchases of high-quality asset-backed commercial paper (ABCP) from money market mutual funds. To further support market functioning, the Federal Reserve agreed to purchase from primary dealers’ quantities of federal agency discount notes, which are short-term debt obligations issued by Fannie Mae, Freddie Mac, and the Federal Home Loan Banks.

On September 19, 2008, the U.S. Treasury Department established a temporary guarantee program for the U.S. money market mutual fund industry. Concerns about the net asset value of money market funds falling below $1 exacerbated global financial market turmoil and caused severe liquidity strains in world markets. In turn, these pressures caused a spike in some short-term interest and funding rates, and significantly heightened volatility in exchange markets. Maintenance of the standard $1 net asset value for money market mutual funds was important to investors. If the net asset value for a fund fell below $1, this undermined investor confidence. The program provided support to investors in funds that participate in the program and those funds will not “break the buck”. This action was to enhance market confidence and alleviate investors’ concerns about the ability for money market mutual funds to absorb a loss.

The Exchange Stabilization Fund was established by the Gold Reserve Act of 1934. This Act authorizes the Secretary of the Treasury, with the approval of the President, “to deal in gold, foreign exchange, and other instruments of credit and securities” consistent with the obligations of the U.S. government in the International Monetary Fund to promote international financial stability.

On September 20, 2008, the Treasury Department submitted legislation to the Congress requesting authority to purchase troubled assets from financial institutions to promote market stability and help protect American families and the US economy.

On September 25, 2008, JPMorgan Chase acquired the banking operations of Washington Mutual Bank in a transaction facilitated by the Federal Deposit Insurance Corporation. JPMorgan Chase acquired the assets, assumed the qualified financial contracts and made a payment of $1.9 billion. Claims by equity, subordinated and senior debt holders were not acquired. Washington Mutual Bank also had a subsidiary, Washington Mutual FSB, Park City, Utah. They had combined assets of $307 billion and total deposits of $188 billion.

On September 29, 2008, central banks announced further coordinated actions to expand significantly the capacity to provide U.S. dollar liquidity. The Federal Reserve announced several initiatives to support financial stability and to maintain a stable flow of credit to the economy during this period of significant strain in global markets. Actions by the Federal Reserve included: (1) an increase in the size of the 84-day maturity TAF auctions to $75 billion per auction from $25 billion beginning with the October 6 auction, (2) two forward TAF auctions totaling $150 billion to be conducted in November to provide term funding over year-end, and (3) an increase in swap authorization limits with the Bank of Canada, Bank of England, Bank of Japan, Danmarks Nationalbank (National Bank of Denmark), European Central Bank (ECB), Norges Bank (Bank of Norway), Reserve Bank of Australia, Sveriges Riksbank (Bank of Sweden), and Swiss National Bank to a total of $620 billion, from $290 billion previously.

On September 29, 2008, Citigroup Inc. announced its intent to acquire the banking operations of Wachovia Corporation; Charlotte, North Carolina, in a transaction facilitated by the Federal Deposit Insurance Corporation and concurred with by the Board of Governors of the Federal Reserve and the Secretary of the Treasury in consultation with the President. (Wells Fargo & Company offered a competing bid on October 3, 2008, which ultimately was accepted.)

The Troubled Asset Relief Program (“TARP”) was signed into law by U.S. President George W. Bush on October 3, 2008. TARP provided up to $700 billion to inject equity into the U.S. banks and to purchase ‘troubled assets’.

On October 3, 2008, President George W. Bush signed the Emergency Economic Stabilization Act of 2008, which temporarily raised the basic limit on federal deposit insurance coverage from $100,000 to $250,000 per depositor. The temporary increase in deposit insurance coverage became effective upon the President’s signature. The legislation provided that the basic deposit insurance limit would return to $100,000 after December 31, 2009. (In fact, the ‘temporary’ limit has remained at $250,000.)

On October 7, 2008, the Federal Reserve Board announced the creation of the Commercial Paper Funding Facility (“CPFF”), a facility that would complement the Federal Reserve’s existing credit facilities to help provide liquidity to term funding markets.

On October 14, 2008, the Treasury announced a voluntary Capital Purchase Program to encourage U.S. financial institutions to build capital to increase the flow of financing to U.S. businesses and consumers and to support the U.S. economy. Under the program, Treasury purchased up to $250 billion of senior preferred shares on standardized terms as described in the program’s term sheet. The senior preferred shares would qualify as Tier 1 capital.

On October 24, 2008, PNC Financial Services Group Inc. purchased National City Corporation, creating the fifth largest U.S. bank.

On November 10, 2008, the Federal Reserve Board and the U.S. Treasury Department announced a restructuring of the government’s financial support of AIG. The Treasury was to purchase $40 billion of AIG preferred shares under the TARP program, a portion of which was to be used to reduce the Federal Reserve’s loan to AIG from $85 billion to $60 billion. The Federal Reserve Board also authorized the Federal Reserve Bank of New York to establish two new lending facilities for AIG: The Residential Mortgage-Backed Securities Facility was to lend up to $22.5 billion to a newly formed limited liability company to purchase residential MBS from AIG; the Collateralized Debt Obligations Facility was to lend up to $30 billion to a newly formed LLC to purchase CDOs from AIG (Maiden Lane III LLC).

On November 18, 2008, Executives of Ford, General Motors, and Chrysler testified before Congress, requesting access to the TARP for federal loans.

On November 20, 2008, Fannie Mae and Freddie Mac announced that they would suspend mortgage foreclosures until January 2009.

On November 21, 2008, the U.S. Treasury Department announced that it would help liquidate The Reserve Fund’s U.S. Government Fund. The Treasury served as a buyer of last resort for the fund’s securities to ensure the orderly liquidation of the fund.

On November 21, 2008, the U.S. Treasury Department, Federal Reserve Board, and FDIC jointly announced an agreement with Citigroup that provided a package of guarantees, liquidity access, and capital. Citigroup issued preferred shares to the Treasury and FDIC in exchange for protection against losses on a $306 billion pool of commercial and residential securities held by Citigroup. The Federal Reserve was to backstop residual risk in the asset pool through a non-recourse loan. In addition, the Treasury committed up to an additional $20 billion in Citigroup from the TARP.

On November 25, 2008, the Federal Reserve Board announced the creation of the Term Asset-Backed Securities Lending Facility (“TALF”), under which the Federal Reserve Bank of New York would lend up to $200 billion on a non-recourse basis to holders of AAA-rated asset-backed securities and recently originated consumer and small business loans. The U.S. Treasury would provide $20 billion of TARP money for credit protection.

On November 25, 2008, the Federal Reserve Board announced a new program to purchase direct obligations of housing related government-sponsored enterprises —Fannie Mae, Freddie Mac and Federal Home Loan Banks—and MBS backed by the GSEs. Purchases of up to $100 billion in GSE direct obligations were to be conducted as auctions among Federal Reserve primary dealers. Purchases of up to $500 billion in MBS were to be conducted by asset managers.

On December 3, 2008, the SEC approved measures to increase transparency and accountability at credit rating agencies to ensure that firms provide more meaningful ratings and greater disclosure to investors.

On December 19, 2008, the U.S. Treasury Department authorized loans of up to $13.4 billion for General Motors and $4.0 billion for Chrysler from the TARP.

On December 29, 2008, the U.S. Treasury Department announced that it would purchase $5 billion in equity from GMAC as part of its program to assist the domestic automotive industry. The Treasury also agreed to lend up to $1 billion to General Motors “so that GM can participate in a rights offering at GMAC in support of GMAC’s reorganization as a bank holding company.” This commitment was in addition to the support announced on December 19, 2008.

By any view, it was a hell of a six-month period.

Postscript: following the Kansas City Financial Stress Index as of today. It shows that there was virtually no stress as of the end of February….