Blogs

Battling COVID-19 & Economic Uncertainty… Lessons Learned

This crisis is following a similar trajectory of other crises, except this is two crises together --- a public health crisis and an economic crisis. The genesis of every crisis is a lack of confidence. When loved ones’ health and economic durability are both...

Teraverde’s Profit Intelligence Solutions and Mortgage Banking Advisory Services Gain Significant Traction in Marketplace

As Demand Increases Teraverde Promotes Mauricio Valverde to Client Success Manager Lancaster, PA. – January 14, 2020 – Teraverde®, the leading provider of profit intelligence and mortgage banking advisory services which transform financial services profitability,...

Today’s Data Intelligence in Mortgage Lending

My kids and I were driving back from a school event, and Bella, my daughter asked me why I was excited about my job. Bella is seventeen years old and Jorge is sixteen, and the only world they have ever known has the iPhone, with all the services, information and...

The Ride-Hailing Disruption

The ride-hailing industry demonstrates the speed and impact of disruption. Disruption occurs quite quickly, and the transformation affects all industry participants (including lenders!). Let’s take a dive into the ride-hailing industry and see how one...

Disruption in Mortgage Lending

The Mortgage Lending Industry, like many others, realizes the need to embrace technology to do more with data. Industry organizations are trying new technology solutions to improve transparency and leverage data intelligence across multiple data sources. One...

Coheus Brings Profitability to Lending

In today’s mortgage market, lenders are struggling with constantly changing rates, rising LO compensation, low productivity, and margin compression. With paper-thin margins Mortgage Bankers are looking for solutions that will help turn the profitability tide. One of...

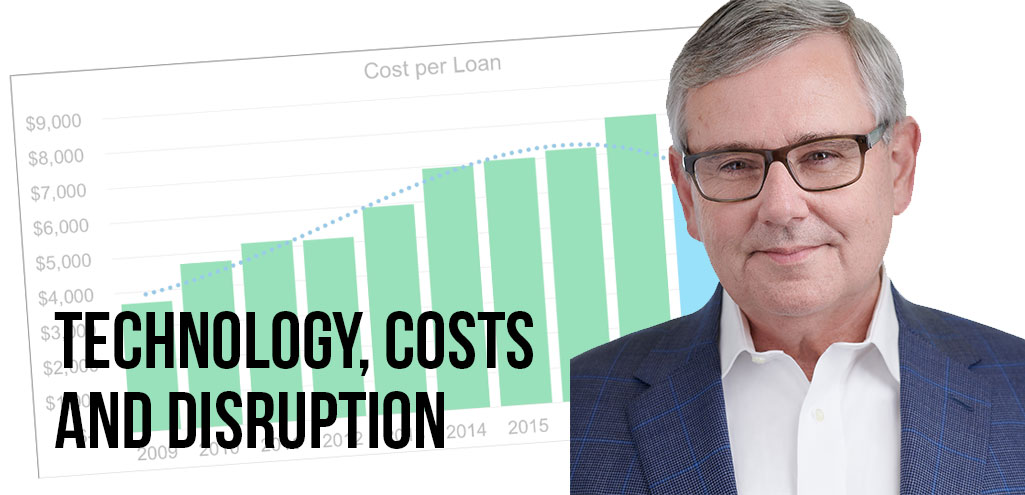

Coheus on Technology, Costs and Disruption

The chart below looks at the history of costs in our industry and what several of our clients have set as aspirational goals. Will we hit the goals? The right question is "under what circumstances can we achieve these goals?" That brings into play the possibilities of...

5 Questions with Jim Deitch

Published in: February 2019 edition. https://thescore.vantagescore.com/article/441/5qs-jim-deitch Jim Deitch is co-founder and chief executive officer of Teraverde®. Previously, he was a co-founder, chief executive officer, and director of the American Home Bank...

Data driven decisions help Oakland Athletics General Manager Billy Beane win

"We are card counters at the blackjack table. And we're gonna turn the odds on the casino:" Billy Beane in the movie Moneyball. “Strategically Transforming the Mortgage Banking Industry” profiled Oakland Athletics General Manager Beane and his data-driven approach to...

Jim Deitch’s New Book is Available Now!

"Strategically Transforming the Mortgage Banking Industry: Thought Leadership on Disruption from Maverick CEOs" is now available for sale online. Get yours today and read it on the way to the MBA's Annual Convention in Washington D.C. next week. “Jim has captured how...