Mortgage Executive Insights

“We’ve interviewed over 100 CEOs, to develop the methodology to identify opportunities in financial services

that are ripe for innovation.

We discuss how innovative thinking can be used as a disruptive weapon to attack and create effective

new fintech models in today’s lending environment.”

Teraverde wrote the books on Digitally and Strategically Transforming the Mortgage Industry.

Disruptive Fintech is an amazon best seller and included in Universities around the world.

Download Chapter 1 of Disruptive Fintech the Coming Wave of Innovation

“A must read for executives seeking an understanding of fintech and how to profit from the rapidly changing real estate finance marketplace.”

Lori Brewer, CEO & Founder, LBA Ware

Other Resources

Four Imperatives for Second Quarter 2021: A Roadmap for Success

The research in this webinar is ripe for lending innovation. We discussed the many shifts in the mortgage industry and direct impact to a lenders profitability.

In the video, we showed strategies lenders can take today to enhance profitability in 2021.

Enjoy the four Imperatives to drive better strategy that creates volumes of opportunities!

Watch the Video

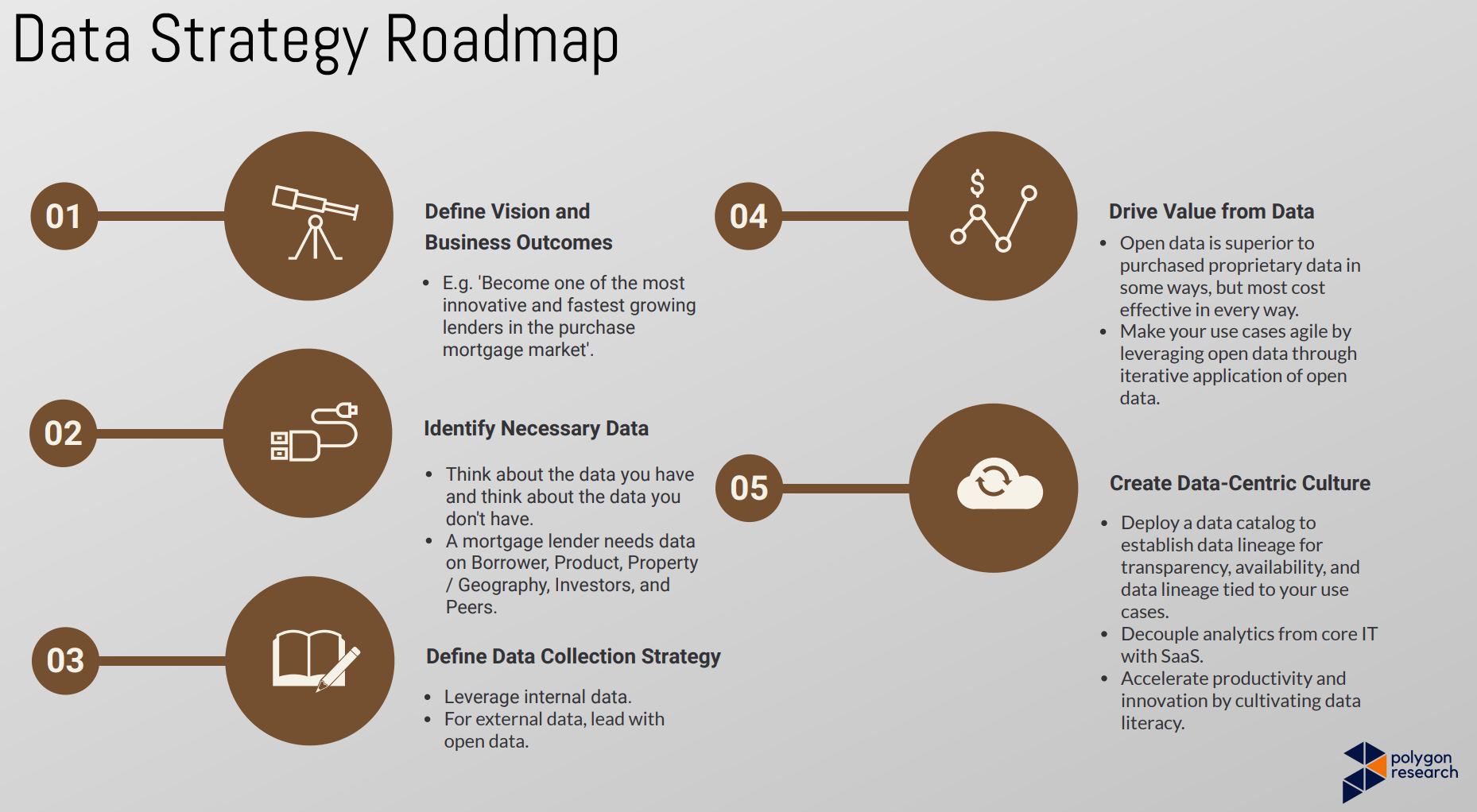

Data Strategy: How to Drive Transformation in the Mortgage Banking Industry

Check out this webinar to learn about Data Strategy with Teraverde and Polygon Research.

Data Strategy refers to a process of aligning your business plan and priorities with your technology stack. In the Mortgage Industry you have a wealth of data, from every loan file, system, and every touch point in the value chain.

We are going to show you how some industry leaders are analyzing Big Data, identifying opportunities on the fly and transforming the business model.

Teraverde Featured in HousingWire Demo Day

Teraverde presents Coheus an executive solution designed to provide lenders critical data about their organization.

- We believe data is powerful and we noticed executives weren’t receiving the data that matters in real time.

- Coheus was designed to present executives with real time data in a simple to use platform.

Teraverde solutions are backed by mortgage executives with 25 years.

“Jim Deitch has written a must-read primer for anyone serious about understanding this industry, especially in the wake of the changes in recent years.”

Dave Stevens, former President & CEO, Mortgage Bankers Association of America

Get Your Free Copy of the Executive Summary

Mortgage Executives are talking…

“The book is written from the eyes of an industry CEO, for industry CEOs and their teams.”

Debra Still, President/CEO of Pulte Mortgage

“Jim did a great job of gathering information across a broad array of executives. Woven this into a comprehensive chart of history and current reflections about where we’ve been and where we are as an industry”

Stanley Middleman, CEO of Freedom Mortgage

“Jim builds a conceptual model to digest the rapid advance of technology and how to apply it as a “C” level executive. A clear road map to customer satisfaction excellence and outstanding profitability.”

Susan Stewart, CEO of SWBC Mortgage Corporation

“Jim Deitch takes you inside the back offices, strategy and industry leaders perspective of the top mortgage banking firms in America. A must read for the industry and consumers.”

Bill Cosgrove, President & CEO, Union Home Mortgage Corp.

“Jim picked 25 ‘maverick CEOs’ for interviews. These mavericks collectively have a great vision for the future of Mortgage Banking and the transformation necessary in the lending business model. Very valuable insights.”

Cody Pearce, President & Co-founder, Cascade Financial Services, LLC

“This book addresses the exact concerns a CEO in the mortgage industry faces. It does so in clear and concise way.”

Jim MacLeod, Executive Chairman, CoastalStates Bank

“Jim Deitch takes readers through the challenges that customers and lenders are facing in the Mortgage Banking Industry.”

Patrick Sinks, CEO & Director, MGIC Investment Corp.

“Success in today’s mortgage industry depends on the combination of intelligent process and advanced technology. A must-read for executives seeking to understand the future of mortgage banking.”

Jerry Schiano, President & CEO, New Penn Financial, LLC

“Jim builds a conceptual model to digest the rapid advance of technology and how to apply it as a “C” level executive. A clear road map to customer satisfaction excellence and outstanding profitability.”

Susan Stewart, CEO of SWBC Mortgage Corporation

From Our Clients

Teraverde is a top tier mortgage vendor.

Teraverde’s services are backed by Certified Mortgage Bankers with over 25 years of lending and Mortgage Technology experts.

Teraverde supports lenders of all sizes, providing a wide range of automated mortgage solutions and executive strategy for innovative lending.