Coheus® turns your static mortgage data into an actionable data intelligence.

You need results now.

Lose the frustration of reports.

Make intelligent, data driven decisions.

What makes Coheus Unique?

Coheus unlocks the value in your data

transforming it into a competitive advantage

Coheus acts as your trusted guiding light

so your company becomes a TopTier performer

Coheus shines a light on opportunities

and turns those opportunities into reality

Coheus uses data-driven intelligence

to cut through the clutter and find opportunities

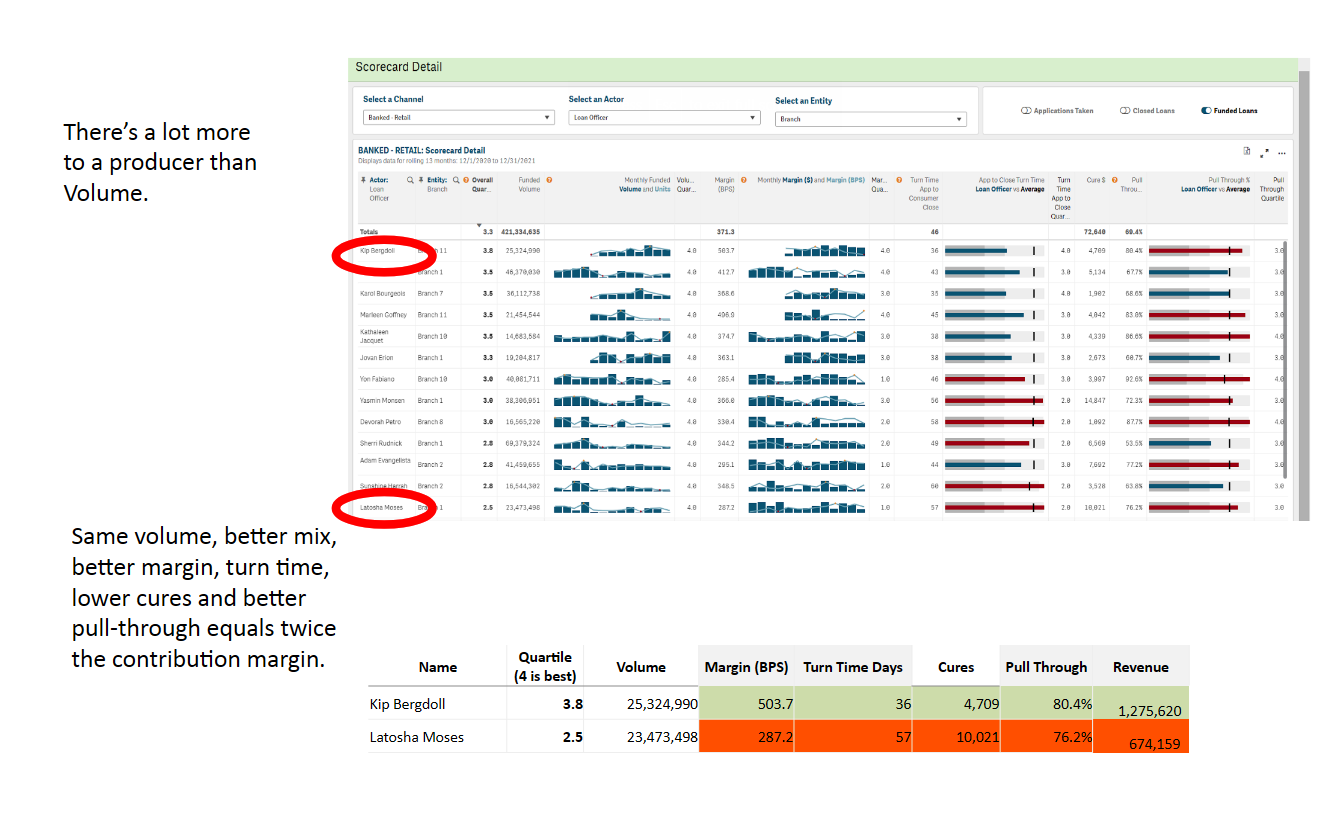

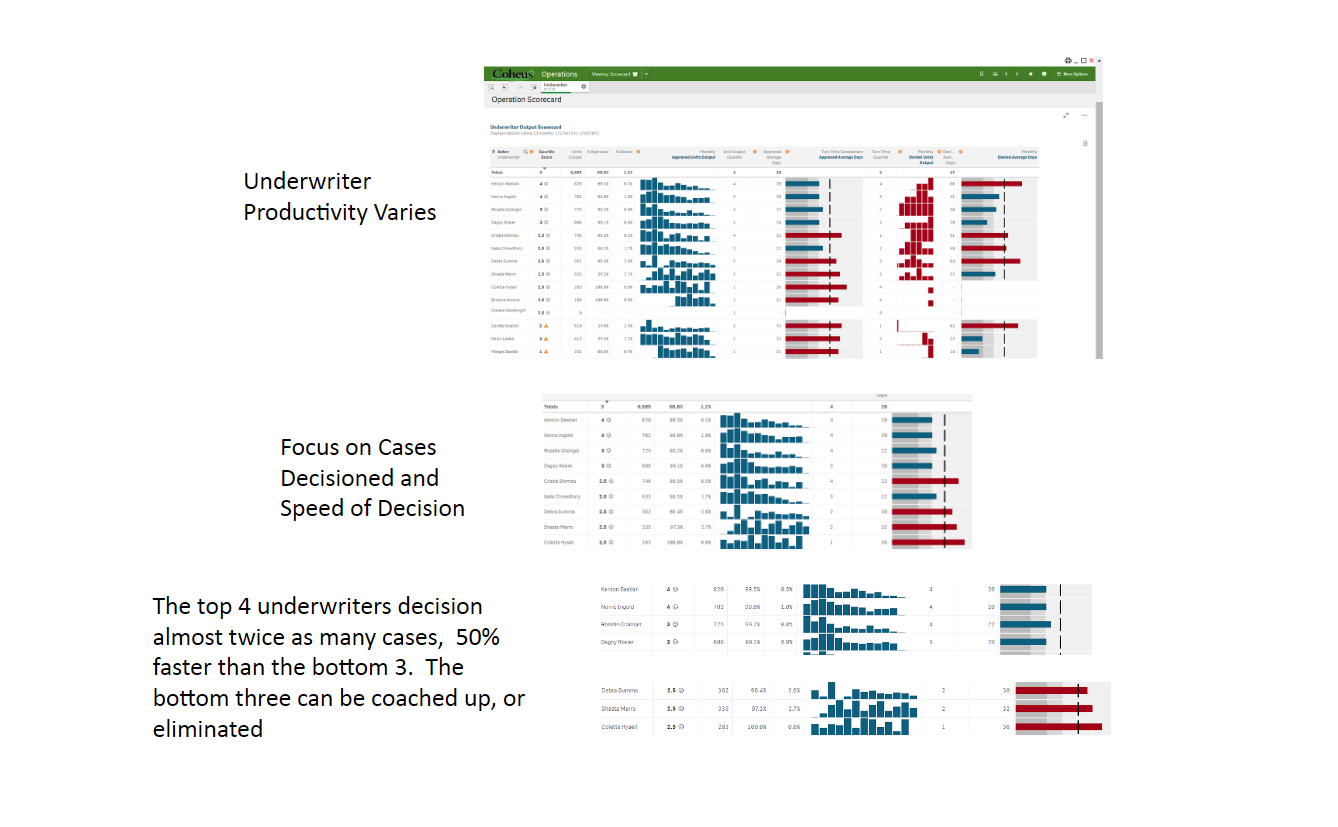

Coheus provides data-driven "Aha" moments

to lift your profits and productivity

TopTiering by Teraverde™

TopTiering by Teraverde™ is the result of extensive research to discover how to optimize the financial services business model for banks, credit unions and mortgage lenders so that they significantly outperform their peers. Coheus doesn’t tell you how to operate, it helps you make decisions about how to operate based on facts.

TopTiering by Teraverde™ can be an unfair advantage as you proactively develop a sustainable financial services business model that is profitable in all market conditions.

Click the images below to see TopTiering by Teraverde™ in action.

People Are Saying...

Get Coheus Now!

- Pre-Configured to provide immediate lift

- Cloud hosted so no hardware to buy

- Access your data within 48 hours

Teraverde Management Advisors, LLC.

Phone: 855-374-8862

590 Centerville Rd

PMB 299

Lancaster, PA 17601

Client Support

https://support.teraverde.com

Sales

sales@teraverde.com

Accounting

accounting@teraverde.com