by Admin | Sep 10, 2019 | Uncategorized

My kids and I were driving back from a school event, and Bella, my daughter asked me why I was excited about my job. Bella is seventeen years old and Jorge is sixteen, and the only world they have ever known has the iPhone, with all the services, information and...

by Admin | Jul 31, 2019 | Uncategorized

The ride-hailing industry demonstrates the speed and impact of disruption. Disruption occurs quite quickly, and the transformation affects all industry participants (including lenders!). Let’s take a dive into the ride-hailing industry and see how one...

by Admin | Jul 10, 2019 | Uncategorized

The Mortgage Lending Industry, like many others, realizes the need to embrace technology to do more with data. Industry organizations are trying new technology solutions to improve transparency and leverage data intelligence across multiple data sources. One...

by Admin | Apr 29, 2019 | Uncategorized

In today’s mortgage market, lenders are struggling with constantly changing rates, rising LO compensation, low productivity, and margin compression. With paper-thin margins Mortgage Bankers are looking for solutions that will help turn the profitability tide. One of...

by Admin | Apr 15, 2019 | Uncategorized

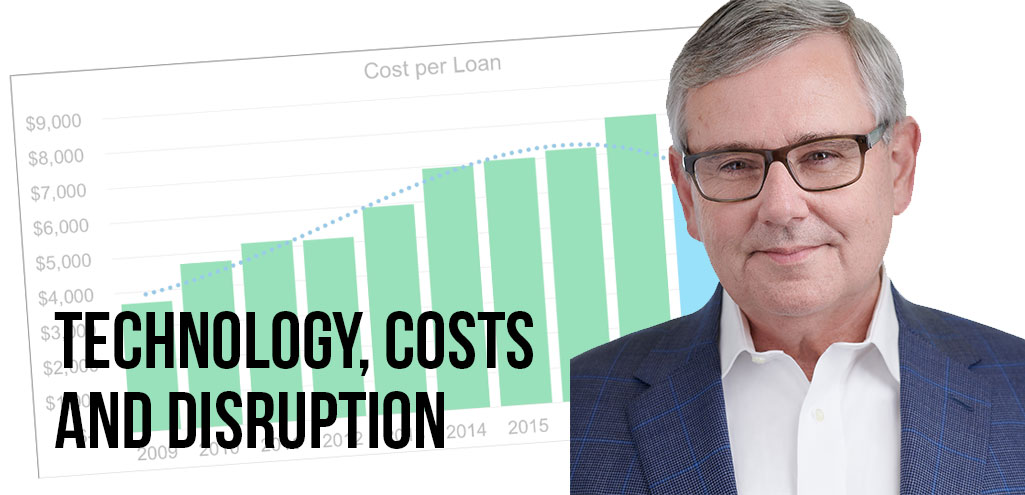

The chart below looks at the history of costs in our industry and what several of our clients have set as aspirational goals. Will we hit the goals? The right question is “under what circumstances can we achieve these goals?” That brings into play the...

by Admin | Feb 15, 2019 | Uncategorized

Published in: February 2019 edition. https://thescore.vantagescore.com/article/441/5qs-jim-deitch Jim Deitch is co-founder and chief executive officer of Teraverde®. Previously, he was a co-founder, chief executive officer, and director of the American Home Bank...