Five Critical Steps to Improve Profitability Improve Efficiency, Productivity and Profitability.

Mike Fratantoni, Chief Economist of the Mortgage Bankers Association published this revised forecast for 2022:

| Industry MBA Forecast ($ Billions of Originations) |

2021 | 2022 | % Change 2022 from 2021 | 2023 | 2024 |

| Purchase | 1,646 | 1,739 | 5.6% | 1,850 | 1,784 |

| Refinance | 2,345 | 861 | -63.3% | 676 | 746 |

| Total | 3,991 | 2,600 | -34.9% | 2,526 | 2,530 |

A pretty brutal forecast for lenders coming off two great years. 2023 and 2024 are also forecast down 35% from 2021/2020. The world has clearly changed. So how do you build a resilient business model that remains profitable in 2022 and beyond?

First, we have to internalize that what worked in 2020 and 2021 isn’t going to work in 2022 and beyond. Margins will further compress. The industry has about 100,000 employees too many.

Second, decisive action is required right now to rapidly adopt a data driven business model to ensure profitability, liquidity and to manage risk.

Following are five critical steps to take right now:

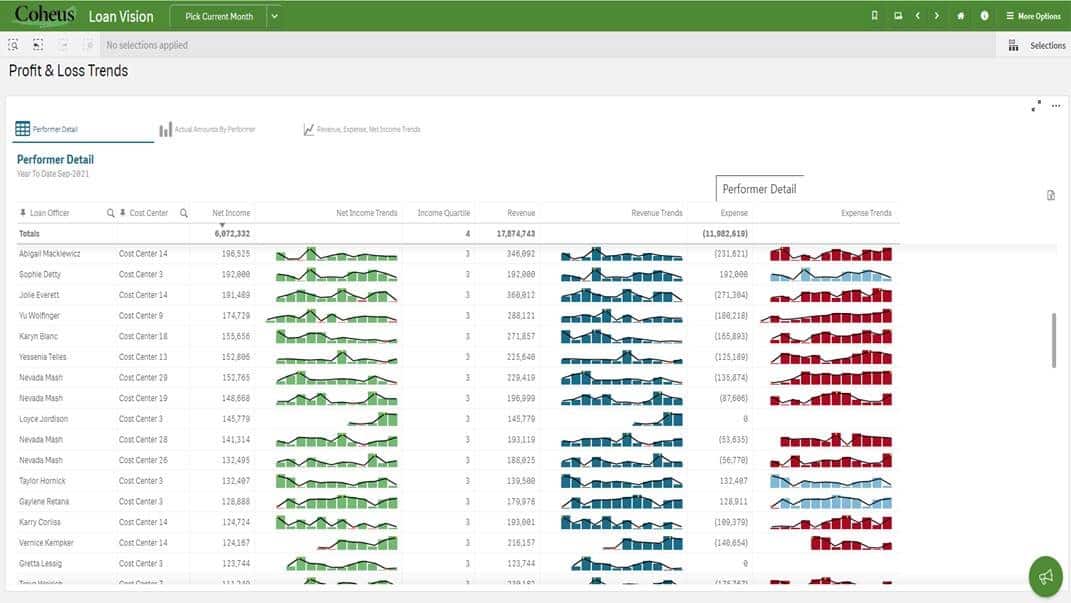

- Rank your originators and AEs on five key metrics: Purchase Volume, Margin after Concessions, Pull-Through, Turn Time and Cures. Using these five metrics, we’ve discovered volume is not representative of profitability. Be proactive, and recruit more purchase oriented originators. Cut the low performers now. Focus on Margin, Pullthrough and Cures to find the true high performers on your team. It’s not just volume, it’s the confluence of these five key metrics to identify the true top performers. Share the results to recognize high performers and to instill some healthy competition. Consider inviting low performers to begin their careers at competitors.

- Rank your operations team. Measure the number of cases and speed of throughput. You may be surprised at the variation in productivity. Consider degree of difficulty of each employee’s workload (credit metrics, loan type, etc.) Share this with the team to encourage transparency and to encourage high performers. Consider inviting low performers to begin their careers at competitors.

- Analyze fall out. It’s not a ‘cost of doing business.’ Certain fallout can be hidden treasure. It can also be an indicator of poor customer service that can be corrected. Know how to find these ‘hidden treasure’ opportunities.

- Make sure you forecast cash every day, and track your loan closings and warehouse dwell constantly. Liquidity and cash are life, especially for IMBs.

- Manage counterparty repurchase risk. Two years of wide open throttles may mean there are loans that have incorrect data. Identify the loans most likely to be subject to repurchase requests (i.e., layered risk, etc.) and ensure the data is correct. Fix any issues now and you can save a lot of expensive headaches later. Act today to prevent needlessly giving back hard earned profits later.

Lenders must implement these five initiatives now, and repeat the effort monthly thereafter. Use Loan Vision and your LOS data to perform these initiatives every month.

Coheus from Teraverde offers you an out-of-the-box solution to perform all five of these initiatives quickly for Loan Vision and Encompass Users. Whether you perform the initiative manually or use a Coheus, you will be well rewarded in terms of future profitability for your efforts.

Using Coheus Mortgage Banking Analytics

Coheus leverages API to transform large data into critical mortgage executive intelligence, the data model and extensive algorithms allows Coheus to provide profitable insights over critical performance metrics. Coheus helps you find the treasures hidden in oceans of data, and use actionable intelligence to improve profit, efficiency and customer satisfaction.

Join us on the upcoming webinar hosted by Loan Vision’s Industry Insights Webinar: Five Critical Steps to Improve Profitability in 2022 and Beyond: February 16th at 2pm ET. Click here to register!

—-

At Teraverde, we believe mortgage bankers should achieve a resilient and flexible business model that sustains superior profitability through all phases of the lending cycle. To achieve that model, we believe Mortgage Executives must “Work on the Business”, not “Work in the Business”.