Strategic Transformation with Data Intelligence

November 22, 2021: “Working on Your Business,” not “Working in Your Business” is the essence of Strategic Transformation. When you think of a strategic plan in an organization, that would transfer the business, or a major function within it. The leader envisions the business operation and works to create an operation that would functions without them day to day. How do you “Work on the Business”?

“Working on Your Business” means thinking about the processes and business functions that occur whether you are there or not. It means the business should run without your hands touching the ongoing work. You are the architect, not the contractor building the structure.

For instance, the Atlanta Braves won the 2021 World Series, by working on the business. Similarly, Southwest Airlines became the most consistently profitable airline of the last 50 years, by working on the business. So, there must be something to “Working on Your Business.”

“Working on Your Business” is the essence of Strategic Transformation. It starts with metrics that matter. What’s truly important, and how do you design the business so key metrics drive your team’s daily behaviors. As an example, let’s look at how an underperforming company was transformed into a very profitable lender.

The Problem

Let’s apply the concept of strategic transformation to a fictional company. We will call it NewMortgage Company. We have created this company using composite data from various mortgage banking enterprises. We have anonymized the data; however, keep in mind that the thrust of the strategic transformation accurately represents the strategies that composite entities.

And that is not all; it accurately represents the transformation of this fictional company to a company that provides exceptional customer service, defect-free loans, and superior profitability.

Solution Through Strategic Transformation

The data that is static shows that NewMortgage is unprofitable because of several reasons. It is possible to use the ‘whack a mole’ strategy and then implement point solutions for this company to improve its results.

Point solutions are purchases of technology or process changes designed to solve a particular issues, not transform the process. A POS is a point solution…unless it is considered as part of an overall evaluation of the business process. For this type of transformation, one must look at the data through multiple lenses, whether the issue comes up from one point of the process, looking at the data from an operational lens, a financial lens, and an executive lens. Leaders can measure the entire process and dig into your data.

Similarly, various workflow management tools can improve throughput, and a business intelligence tool could look at loan production statistics. Real-time performance metrics are important as they allow mortgage lenders to respond proactively, rather than reactively, to shifts in the market and keep their mortgage businesses viable as well as adaptable for the future. It is also possible to use ad hoc exception reporting. But none of this is Strategic Transformation.

Conducting Strategic Transformation

NewMortgage was finding it hard to be consistently profitable, even though volume was growing. The CEO conducted a Strategic Transformation in order to set the future state of the business. After thoughtful consideration and deliberations, NewMortgage decided to ”Work on the Business” by developing a business model produce reliable and consistent profitability.

The company adjusted product mix to focus on loan officers to produce a consistent and targeted loan volume commensurate with commissions and cost structure. The need for consistent profitability drove many elements of the Strategic Transformation.

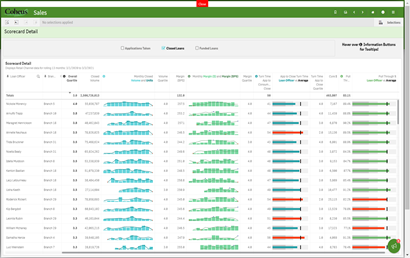

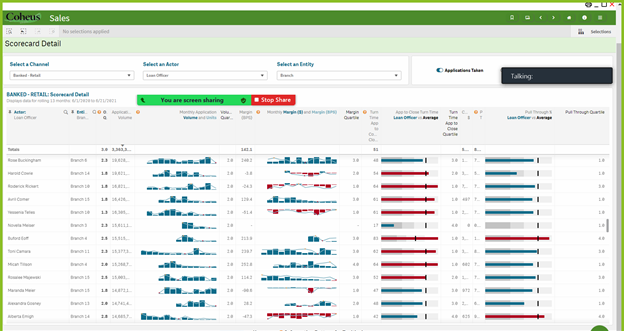

The lower performers are illustrated below:

You get the idea.

Volume is not everything, and focusing on metrics that matter is the beginning of the Strategic Transformation process. For an in-depth review of the Strategic Transformation in Mortgage Banking Download this Excerpt. The guide offers a real-world case study of the strategic transformation and how lenders are achieving successful outcomes with real time data. The excerpt is a summary of chapter 7 in Strategically Transforming the Mortgage Banking Industry: Thought Leadership on Disruption from Maverick CEOs.

Working on the Business, Not In It

Open the 1 hour webinar on mortgage executive strategy and data intelligence:

—-

At Teraverde, we believe mortgage bankers should achieve a resilient and flexible business model that sustains superior profitability through all phases of the lending cycle. To achieve that model, we believe Mortgage Executives must “Work on the Business,” not “Work In the Business.”

Coheus is Teraverde’s Actionable Intelligence solution that continues to help executive achieve superior profitability. The solution Teraverde provides delivers real time data and actionable insights over the lending business on an easy to use platform. Access the video for Coheus.

Download the Applied Strategic Transformation Guide

Using Baseball Analytics Application

Click below to use real time data analytics and how it’s used in baseball. Users can see which teams are cost effective in winning and which are spending way too much to win.